The market for sensors in smartphones and tablets is set to nearly triple from 2012 through 2018, propelled by the race between Apple and Samsung to enhance their mobile products with cutting edge sensor technology.

The market for sensors in smartphones and tablets is set to nearly triple from 2012 through 2018, propelled by the race between Apple and Samsung to enhance their mobile products with cutting edge sensor technology.

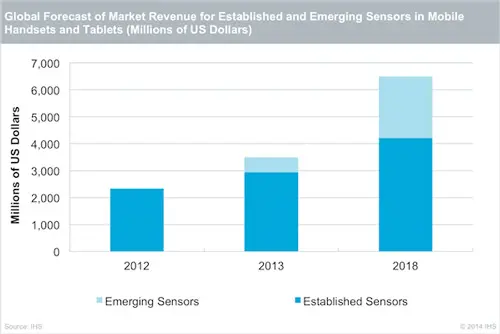

According to IHS, worldwide market revenue for sensors used in mobile handsets and media tablets will rise to $6.5billion in 2018, up from $2.3bn in 2012.

The fastest growing portion of the mobile sensor segment will be emerging devices, whose revenue will surge to $2.3bn in 2018, up from just $24million in 2012. In 2013, this segment posted dramatic growth, with revenue rising to more than $500m.

"The next wave of sensor technology in smartphones and tablets has arrived," said Marwan Boustany, IHS senior analyst for MEMS and sensors. "Led by Apple and Samsung, the mobile market is moving beyond simply integrating established devices like motion sensors and now is including next generation features like fingerprint and environment/health sensors. Adoption of these newer devices will drive the expansion of the mobile sensor device market in the coming years."

Established sensors in mobile devices include motion sensors, light sensors and MEMS microphones. Emerging sensors consist of new devices including fingerprint, optical pulse, humidity, gas, UV and thermal imaging sensors.

Apple initiated the market for fingerprint sensors in mobile devices with the release of the iPhone 5s in 2013.

"IHS forecasts that shipments of fingerprint enabled devices will reach 1.4bn units in 2020," Boustany said. "This is more than four times the 317m units expected to be shipped by the end of 2014."

The fingerprint sensor market is beginning to gain traction at other companies outside of Apple, too. New devices with fingerprint sensors include Samsung's flagship model – the Galaxy S5 – and Huawei's Ascend Mate 7, both of which began shipping in 2014.

For its part, Samsung has pioneered the deployment of other devices, including environmental and health sensors in the flagship models introduced by the company during the last 18 months. Samsung rolled out a humidity sensor in the Galaxy S4, a pulse sensor in the Galaxy S5 and a UV sensor in the Note 4.

Fingerprint sensors play a key role in mobile payment services, providing authentication for systems like Apple Pay. Other banks and financial institutions, including Visa, MasterCard and PayPal are also working to support mobile payments and biometric authentication.

"This fingerprint market has all its requirements for success converging at the right time," Boustany noted.

Mobile payment services are expected to gain popularity not just in Europe and North America, but also in Asia.

With the increasing demand for sensor technology in Asia, IHS belives Chinese smartphone OEMs will be the next driver for a new generation of sensors.

Author

Laura Hopperton

Source: www.newelectronics.co.uk